This past week marked an important milestone for Kenya’s legal and technology ecosystem. As conversations around Fintech in Kenya continue to evolve, Thomas Louis Advocates (TLA) officially entered the scene, not with fanfare, but with meaningful dialogue. Through an engaging and insightful Tech Law Webinar, the firm brought together thought leaders, investors, and innovators to unpack what’s next for financial technology, regulation, and the future of funding in the digital economy.

For a country long recognized as the cradle of mobile money, Fintech in Kenya is no longer just about M-Pesa or payments. It’s about digital assets, stablecoins, cross-border transactions, and the complex legal frameworks that now define how innovation scales responsibly. This moment, both for the industry and for us at TLA, represents more than a discussion. It’s a signal that Kenya’s digital transformation is maturing, and that trusted legal counsel is now an essential part of that journey.

The Current Pulse of Fintech in Kenya

Kenya’s fintech sector has become one of the most dynamic in Africa, attracting startups, venture funds, and global tech attention. Yet despite this growth, the numbers tell a deeper story. According to recent insights, less than 10 percent of total venture funding in Kenya currently flows into fintech, a surprising figure for a country once hailed as Africa’s fintech capital.

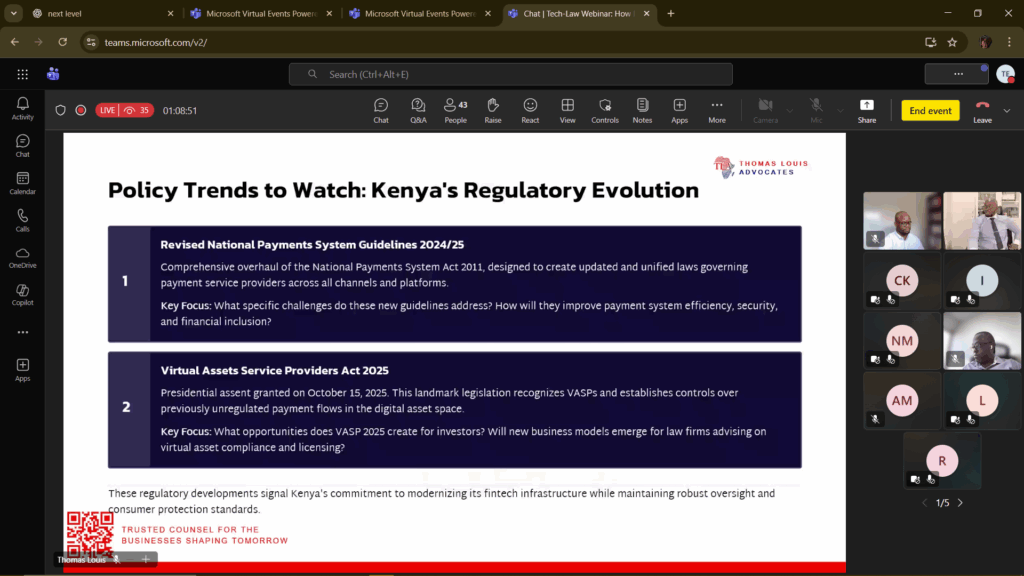

That gap reflects both opportunity and caution. Regulatory frameworks are catching up. The Virtual Asset Service Providers Act, passed earlier this year, was a clear step toward managing risk in the crypto and digital asset space. For fintech innovators, investors, and even traditional banks, understanding how to navigate these new boundaries is critical.

Fintech in Kenya today sits at the intersection of innovation and regulation. The Central Bank continues to encourage financial inclusion, while new data protection and consumer protection laws demand compliance maturity. Whether you’re launching a payments platform or expanding into DeFi products, success depends on strategic legal foresight, the kind that balances growth with governance.

Why Legal Expertise Matters Now More Than Ever

As fintech matures, legal complexity becomes the new normal. Licensing, data handling, cross-border payments, taxation, intellectual property, these are no longer back-office issues. They are boardroom priorities.

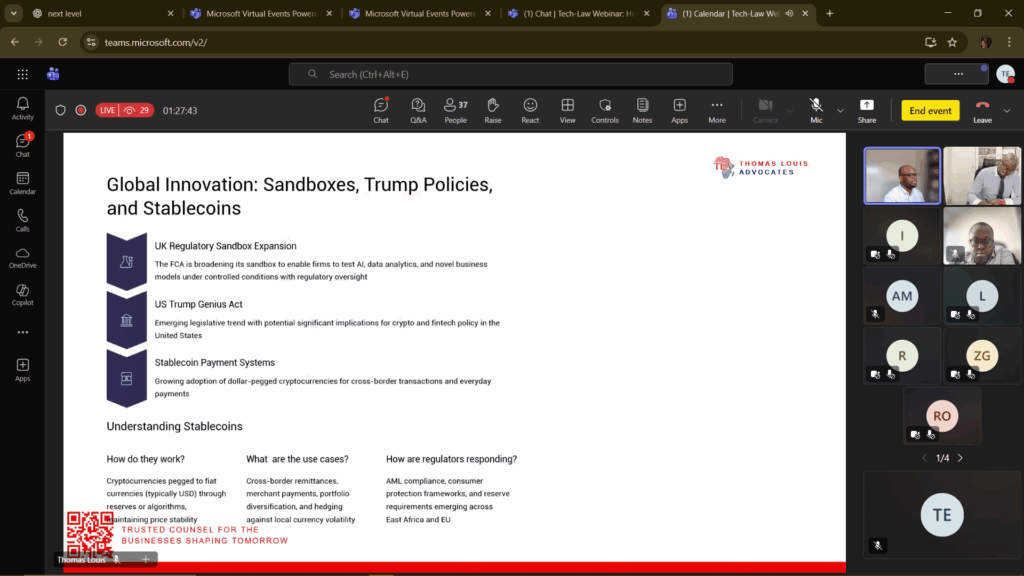

The conversation we hosted during our inaugural Tech Law Webinar captured this perfectly. Our distinguished panelists, Mathew Saisi and Isaac Kibere ACIArb, explored how laws are evolving to match the speed of digital transformation. Discussions around the Virtual Assets Service Providers Act, the rise of stablecoins, and emerging global regulations like the Genius Act underlined one truth: the rules of financial innovation are being rewritten, and Kenya is part of that global dialogue.

For stakeholders operating in Fintech in Kenya, the challenge is not innovation itself, it’s staying compliant, protected, and future-ready in a market that changes faster than the law can adapt. That’s where legal insight turns into competitive advantage.

Insights from Our Inaugural Webinar

Our recent Tech Law Webinar was more than an event, it was a reflection of the growing need for structured legal guidance within Kenya’s technology sector. With over thirty delegates in attendance, the session unpacked how Fintech in Kenya is shaping up under the pressure of innovation, funding constraints, and regulatory shifts.

Participants explored key issues such as how stablecoins could redefine remittances, how the Virtual Assets Service Providers Act will affect startups and exchanges, and why fintech continues to attract less funding than other sectors like Energy or Healthcare.

For Thomas Louis Advocates, this discussion was timely. The firm’s launch and the webinar represented a convergence of two realities, a rising wave of innovation, and the urgent need for legal frameworks that allow that innovation to thrive responsibly.

How Businesses and Investors Should Respond

For founders, investors, and corporates active in Fintech in Kenya, this moment calls for strategy. The growth potential is massive, but the pitfalls are equally real. Every new fintech product, from mobile-based credit scoring to digital wallets, triggers legal questions:

- Are you operating within the scope of existing CBK guidelines?

- Are you compliant with data protection regulations?

- Do you understand the intellectual property implications of your platform’s architecture?

These are not academic concerns. They directly influence valuations, investor confidence, and scalability. That’s why businesses at the forefront of Fintech in Kenya must integrate legal counsel early, not as an afterthought, but as part of their innovation DNA.

At Thomas Louis Advocates, we have structured our advisory model to bridge that gap. Our Technology and Commercial Law practice is built to help fintechs, startups, and investors navigate licensing, regulatory approvals, data governance, and cross-border compliance. We don’t just interpret the law; we help clients translate it into growth.

Looking Ahead – The Next Chapter for Fintech in Kenya

The future of Fintech in Kenya lies in collaboration between innovators, regulators, and legal professionals. We’re seeing new opportunities emerge in embedded finance, digital identity, and cross-border remittance solutions. Regional harmonization under the African Continental Free Trade Area (AfCFTA) will further open doors for scalable fintech products that can operate across multiple jurisdictions.

Yet, with every innovation comes scrutiny, from regulators, consumers, and even competitors. The firms that win in this environment will be those that embed legal foresight into their business model from day one.

Kenya’s fintech story is far from over. In many ways, it’s entering its most defining chapter. And as the sector expands across East Africa, the demand for clarity, compliance, and credible counsel will only grow.

Conclusion

The discussions that began this week through our webinar were not a conclusion, they were a starting point. A new chapter for Fintech in Kenya, and a new phase for how law and technology can work hand in hand to drive sustainable innovation.

At Thomas Louis Advocates, we remain committed to guiding that journey. By combining deep legal expertise with a forward-looking view of technology, we aim to be the trusted counsel behind the next wave of fintech success stories in Kenya and beyond.

Stay connected with us as we continue the conversation on Fintech in Kenya, and explore how law can empower innovation rather than limit it.

🌐 www.tladvocates.com

Follow us: LinkedIn | Instagram | Facebook | X | TikTok | Google Business

See Why You Should Talk to Fintech Lawyers in Kenya Before You Invest in Kenya’s Digital Finance Space